Chase Transfer Partners: Who They Are & When to Use Them

Secrets Resort in Montego Bay, Jamaica, 2024 (Booked with Hyatt points transferred from Chase bank)

If you’ve ever looked at your Chase Ultimate Rewards® points and thought,

“Okay… I have the points. Now what?” — this post is for you.

One of the biggest reasons Chase points are so valuable is because of their transfer partners. Used correctly, transferring points can unlock flights and hotels that would cost thousands of dollars in cash — sometimes for just a few dollars in taxes and fees.

What Are Chase Transfer Partners?

Chase transfer partners are airlines and hotel programs that allow you to move your Chase Ultimate Rewards points directly into their loyalty programs.

Sometimes the Chase travel portal at a fixed value isn’t the best option, though they just introduced the points boost that seems very lucrative so far. With transferring points, you can:

Transfer points to an airline or hotel. You will need to create an account with them so you obtain a specific account # to put into your Chase transfer page.

Book an award flight or hotel night through that program

Often get 2x–5x more value per point

Transfers are typically 1:1, meaning:

10,000 Chase points = 10,000 airline or hotel points

⚠️ Important: Transfers are one-way and permanent. Once you move points to an airline or hotel partner, you cannot move them back to Chase.

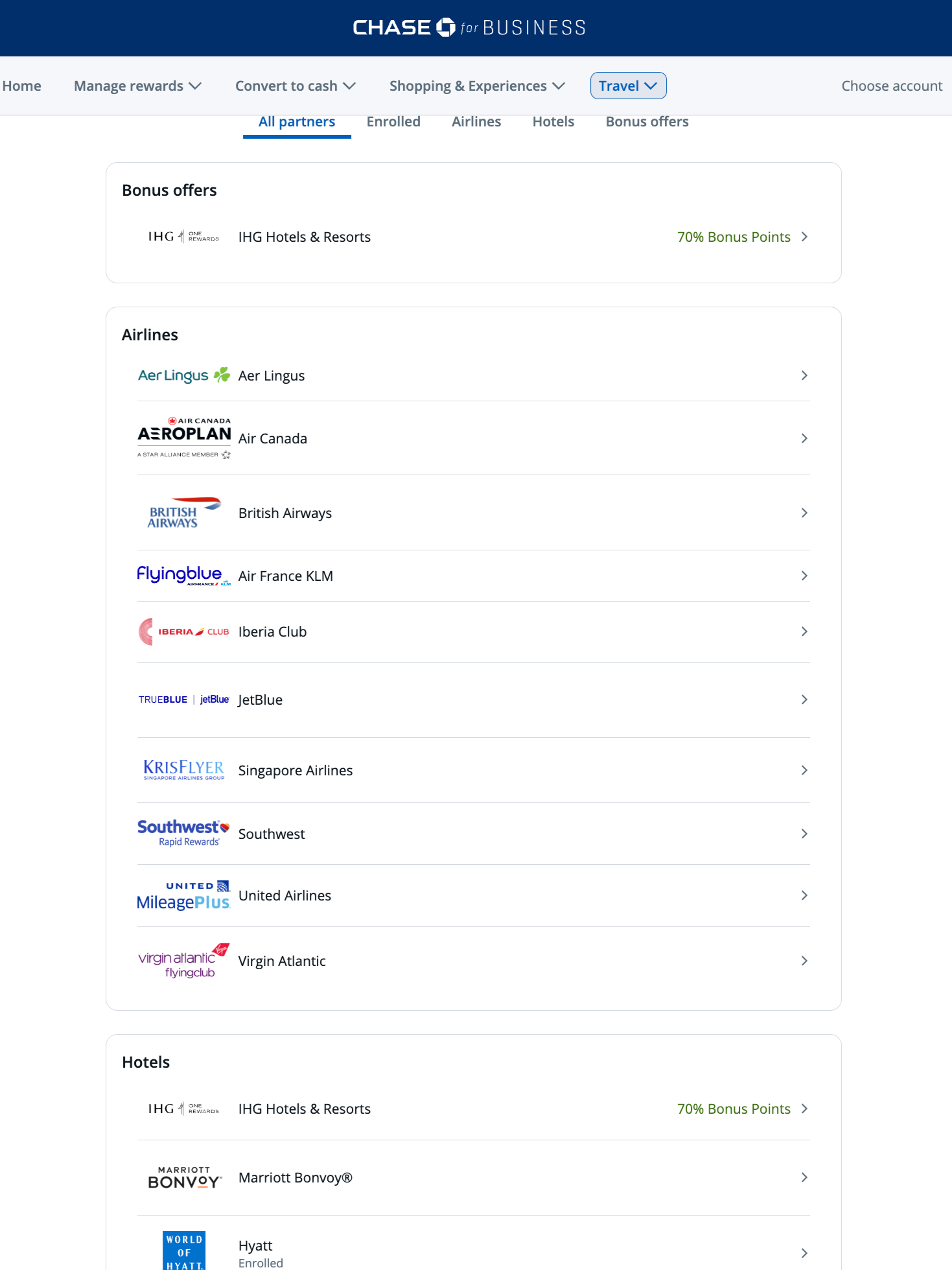

Screenhshot of the transfer to partners page on Chase bank site

Which Chase Cards Allow Transfers?

Not all Chase cards have transfer partner access.

You can transfer points if you have:

Chase Sapphire Preferred®

Chase Sapphire Reserve®

Ink Business Preferred®

If you earn points on cards like:

Chase Freedom Flex®

Chase Freedom Unlimited®

Ink Business Cash® or Ink Business Unlimited®

You can still use transfer partners — you just need to combine those points into one of the cards above first.

Chase Airline Transfer Partners (as of the time of this blog post):

✈️ United Airlines (Star Alliance)

Best for:

Domestic flights

International flights to Europe, Asia, and Australia

No fuel surcharges

Great option if you want simple bookings or live near a United hub.

✈️ Southwest Airlines

Best for:

U.S. and Caribbean travel

Families

Companion Pass holders

Southwest points are revenue-based, meaning prices track closely with cash fares — but the real magic happens if you have the Companion Pass. You can read more about that here.

We prefer getting our Southwest points through the co-branded Southwest cards, but when we first started out and didn’t have any other points yet, we transferred from Chase to Southwest for our first big redemption.

✈️ Air Canada Aeroplan

Best for:

International flights on Star Alliance partners

Business class redemptions

Flexible routing

Aeroplan is a favorite for advanced redemptions with excellent partner access.

✈️ British Airways Executive Club (Avios)

Best for:

Short nonstop flights

American Airlines redemptions

West Coast to Hawaii flights

Distance-based pricing can mean amazing deals — or terrible ones — so route selection matters here.

✈️ Air France / KLM Flying Blue

Best for:

Flights to Europe

Monthly Promo Rewards

Good availability

Flying Blue often runs discounted award pricing that can save tens of thousands of points.

✈️ Virgin Atlantic Flying Club

Best for:

Delta One business class

Flights to Europe

Sweet spot partner awards

This is one of the highest-value (but least obvious) Chase partners when used correctly.

✈️ Iberia Plus

Best for:

Off-peak flights to Spain

Business class deals to Europe

Lower taxes and fees than British Airways for similar routes.

✈️ Singapore Airlines KrisFlyer

Best for:

Premium cabin flights

Singapore Airlines awards (not bookable elsewhere)

Great option if you want access to Singapore’s world-class cabins.

✈️ Emirates Skywards

Best for:

Luxury flights

Unique experiences

Emirates premium cabins

High fees, but unforgettable redemptions.

Chase Hotel Transfer Partners

Chase has few hotel partners — but they’re strong ones.

🏨 World of Hyatt

Best for:

Maximum value per point

Luxury stays

Family-friendly resorts

Hyatt is widely considered the best Chase hotel partner. Award charts are still reasonable, and redemptions can be incredible.

🏨 IHG One Rewards

Best for:

Broad hotel footprint

Budget and mid-range stays

International travel

IHG points aren’t always the highest value, but they can work well if you need to top off points for a specific trip.

🏨 Marriott Bonvoy

Best for:

Global hotel availability

Large footprint

Luxury properties

Usually lower value per point, but sometimes useful when availability matters more than value.

When Should You Transfer Chase Points?

You should transfer points only when:

✅ You’ve found award availability

✅ You know the exact number of points needed

✅ You’re ready to book immediately

Never transfer points “just to have them there”, unless you are experienced and know exactly which program you will use in the future.

When You Should NOT Transfer Points

❌ If the portal price is similar - it’s better to buy directly through the hotel, airline or touring company as the portal is considered “third-party”. It’s not impossible, but if there’s a hiccup in the plans, it takes more time to go through Chase to change or cancel something.

❌ If award availability is limited — sometimes the bank’s portal is Sold Out, but you may find availability through the hotel’s website or vice versa.

❌ If you’re unsure of your plans

❌ If taxes and fees are high

These factors obviously depend on how much money and time you are willing to spend to make your specific trip happen. Sometimes the Chase portal is the better option — and that’s okay. We’ve used plenty of Ultimate Rewards points to book our rental cars through the portal because we try to make our trips as close to free as possible.

Real-Life Example

Let’s say a flight to Europe costs:

$1,200 cash

60,000 points through the Chase portal

30,000 points via a Flying Blue transfer + ~$100 in taxes

That’s the power of transfer partners.

Final Thoughts: Why Chase Transfer Partners Matter

Chase transfer partners are what turn “free travel” from a buzzword into reality.

You don’t need to use them for every trip — but when you do, they can unlock:

International flights for pennies

Luxury hotels for free

Experiences you wouldn’t otherwise pay for

If you’re just getting started, begin with Hyatt, Southwest, and United — then branch out as you get more comfortable.

And remember:

✨ Points don’t expire when you leave them with Chase — so wait until the right redemption shows up.